There has been a lot of talk about the US Dollar lately. According to a growing sleuth of Dollar bears awaking from hibernation, the US Dollar’s days as the world’s preferred reserve currency are over. Calls for an imminent and significant devaluation in its value are making headlines on a regular basis. Theories about the potential causes for the US Dollar’s demise vary, but the most prominent argument emanates from the move by a number of countries, including: Brazil; Russia; India; and China, to settle financial transactions amongst one another in their respective local currencies. Furthermore, the BRICS group of countries have received a number of applications from other nations wanting to join the “club”, potentially increasing the group’s economic muscle further. The “petrodollar” is also said to be at risk as China is negotiating with Saudi Arabia to buy oil with Renminbi as opposed to US Dollars. Even European Union member France has reportedly settled some energy related transactions with China in Yuan. It is said that increasing settlement of global financial transactions in currencies other than the US Dollar will reduce the demand for the Greenback and lead to weakness. This might prove problematic for the highly indebted United States, who relies on the US Dollar reserve currency status to “print” US Dollars to fund their long-standing trade deficit and pay interest on their eye watering USD 32 Trillion debt pile.

But these issues are not new and the US Dollar has been in the firing line many times post World War II, yet it is still the world’s biggest currency by a wide margin.

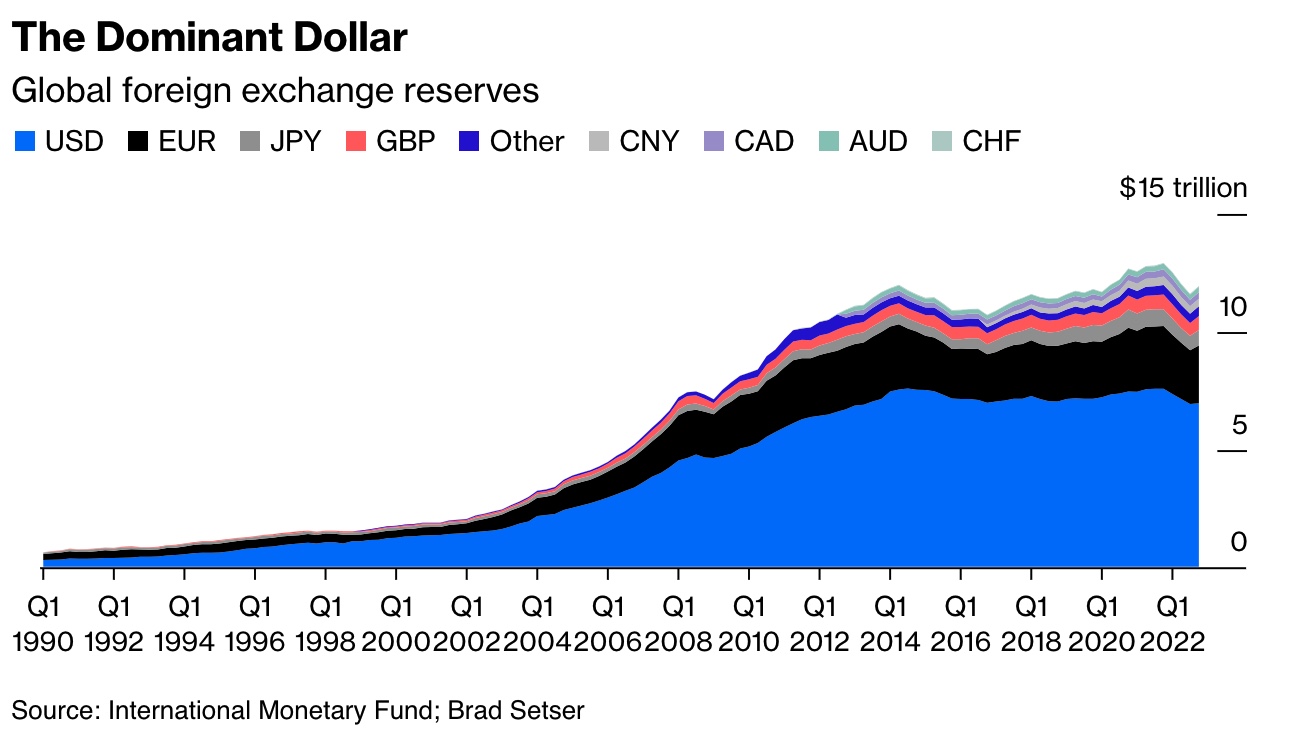

According to the International Monetary Fund, the US Dollar represents 60% of international reserves, well ahead of the Euro at 20% and the Chinese currency at barely 3%… According to the Bank for International Settlements, the US Dollar’s share of international transactions has been fairly stable at between 80% and 90% since the late 80’s.

There is also some strong resistance against the “De-dollarization” theory. Larry Summers, former US Treasury Secretary, said: “You cannot replace something with nothing. What other currency is preferable to the dollar as a reserve and trade currency, when Europe’s a museum, Japan’s a nursing home, China’s a jail, and Bitcoin’s an experiment?”

It is interesting that the emergence of these US Dollar doomsday predictions coincides roughly with what seems to be a turning point in the US Dollar’s value versus the Euro and British Pound about a year ago. Indeed, since late September 2022, when the US Dollar broke parity against the Euro (the US Dollar traded as low as 96 cents to the Euro), it has depreciated approximately 15% against the Euro and 20% against the British Pound. One can be forgiven for having concerns after such poor performance and contemplating the prospects for the US Dollar. Are we witnessing the impact of structural changes in global currency markets, and will the US Dollar’s recent weakening persist, or are we merely observing normal cyclical behavior in the value of global currencies?

The chart below shows the US Dollar / Euro exchange rate since the turn of the century. A few high-level observations are worth highlighting:

- Since 2000 to date, the US Dollar has depreciated approximately 10% against the Euro

- After depreciating by a whopping 50% against the Euro between 2000 and 2008, the US Dollar has gradually appreciated relative the Euro

- Over the period, there have been 7 shorter-term cycles during which the US Dollar depreciated in excess of 12,5% against the Euro

A great exercise is to look at what popular opinion was at turning points in the US Dollar’s fortunes. For this purpose, we refer to the Economist magazine covers for some guidance (see video below).

Clearly, typically when the US Dollar featured on the Economist cover, it turned out to be a good contrary indicator. It’s possible that journalists cover a story only once it has run its course. It might therefore be wise to question the narrative after a big move in an asset’s price (like a currency, for instance) has taken place.

The US Dollar may well be impacted by the de-dollarization forces, however, there might also be fundamental economic factors to consider, like relative economic performance and relative interest rates, which, in our opinion, favour the US Dollar. But alas, without the benefit of the proverbial crystal ball, we prefer to maintain a broad balance to major world currencies in our client’s portfolios.