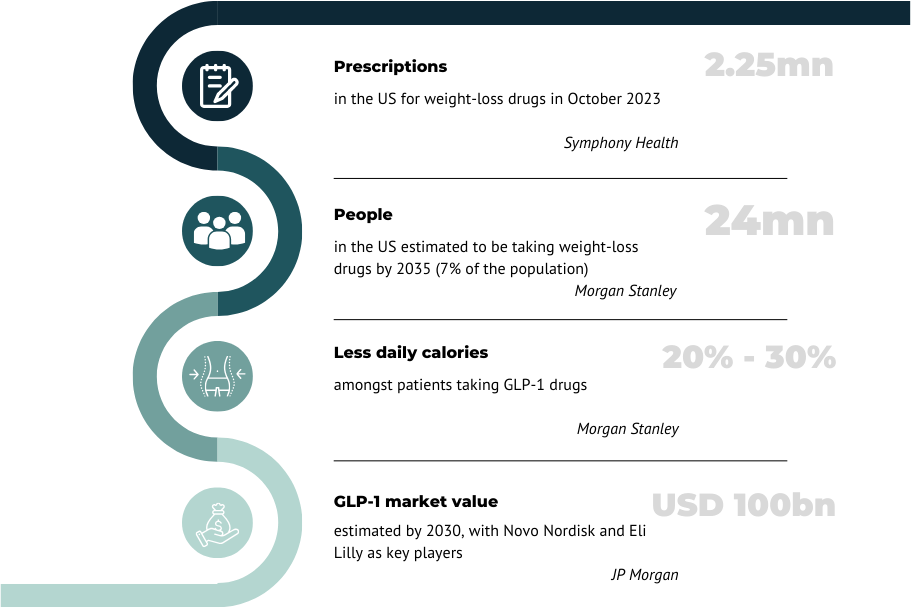

With an estimated 750 million people globally suffering from obesity, the market for weight loss drugs is estimated to reach USD 100 billion by 2030 (Goldman Sachs). Around 70% of the US population is overweight and 45% is classified as obese.

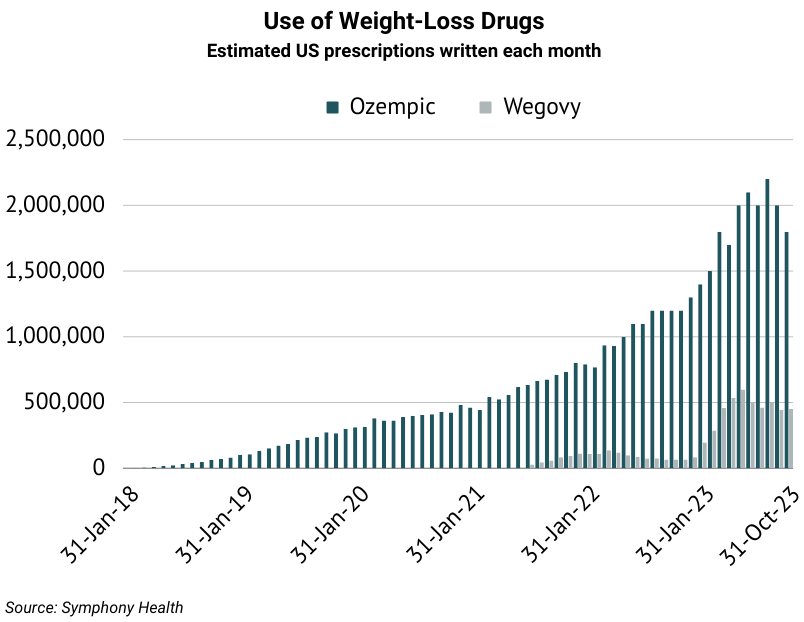

GLP-1 drugs have been making headlines as companies rake in the profits off the back of unfathomable demand and resultant sales. The industry leaders in this market are Novo Nordisk and Eli Lilly. Wegovy (Novo Nordisk) and Mounjaro (Eli Lilly) regulate one’s appetite by suppressing hunger. For the first half of the year, these drugs contributed to earnings growth of 32% and 28% respectively for the two companies. According to Symphony Health, monthly prescriptions for weight loss drugs in the US have increased 63% in 2023 (to the end of October) and are up 366% from 2020. The graph below shows the increase in prescriptions for Ozempic and Wegovy (Novo Nordisk), over the past 5 years, to October 2023.

Morgan Stanley anticipates 7% of American adults to be taking these weight loss drugs by 2035, resulting in a 1.3% reduction in overall US calorie consumption.

With demand skyrocketing, drugmakers are unable to keep pace. Other criticisms for the implied market growth include:

- Cost: these drugs are priced between USD 900 and USD 1,300 per month

- Limited insurance coverage: many insurers do not cover weight loss treatment

- Side effects: such as nausea and intestinal abnormalities

- Uncertainty over long-term impacts

While the likes of Novo Nordisk and Eli Lilly enjoy growth, adjacent industries, from diet product producers, to gyms and even food retailers, fear the impact these new drugs will have on sales. A recent article from Bloomberg highlighted the expected impact on sales over the Thanksgiving period, while the Washington post quoted Conagra (operating within the consumer packaged goods industry) chief executive Sean Connolly, who believes industries will adjust to changing consumer patterns which will evolve over a multi-year period. Positive or negative, the speculated ripple effect on industries has been making headlines over the past month. Below is a deeper look into some of the more prominent themes we have seen emerge for debate.

Diet Companies & Gyms

Although some diet companies have tried to keep pace by selling GLP-1 drugs themselves, many have fallen behind. Jenny Craig weight loss centres closed down earlier this year, after 40 years of operating. Medifast, a diet product producer, indicated a 35% decline in earnings attributable to the introduction of these drugs.

Some believe gyms will be under pressure due to less demand as those taking these drugs don’t need to be active; while others expect gyms to benefit from a healthier community. Morgan Stanley research is supportive of the latter, with 71% of the respondents in a survey exercising weekly after taking these drugs, versus 35% prior.

Food Retailers, Restaurants & Fast Food Chains

During the most recent set of earnings, larger retailers have additionally brought up the impact of these drugs on sales of products. According to Walmart, data from their loyalty programmes revealed that consumers were purchasing fewer groceries and less calories. The commentary from food retailers resulted in food and beverage shares (for example: Krispy Kreme, PepsiCo, Coca-Cola, Hershey, Kellogg and Mondelez) coming under pressure.

The beverage industry has been highlighted as one of the industries which are particularly vulnerable to changing consumer behaviours. Studies have shown that 65% of obesity drug patients have cut back on sugary carbonated drinks, while 62% have cut back on alcohol.

Others have been cited as staying at the forefront of new trends. Nestle, for example, highlighted the opportunity this creates for their Lean Cuisine meals. Morgan Stanley sees this as an opportunity for fresh fruits and vegetables retailers whose sales they foresee surging.

Fast food chains are trying to decipher how best to navigate a decline in appetite amongst consumers, whilst analysts have additionally been sceptical about restaurants in this new environment. Some restaurants however, such as Darden Restaurants, have shown less concern, stating that they do not foresee it having a meaningful impact. They believe patrons will be encouraged to still “eat out” for the social aspect.

Hospitals and MedTech

Medtronic announced they had seen a decline in bariatric surgery earlier this year. In early October, the most recent trial of Ozempic (Novo Nordisk diabetes drug undergoing trial for approval as a weight loss drug) resulted in large declines for companies operating in the healthcare sector as the trial showed benefits for those suffering from kidney disease. Australian listed ResMed (producer of sleep apnoea devices) and CSL (kidney dialysis business unit) have both come under pressure due to the perceived decline in demand for their products as a result of a decline in obesity.

Some analysts foresee a reduced demand for healthcare, while others see a shift in required treatments as people become more active and live longer. Another area which has been highlighted as a beneficiary is those companies who produce syringes as most of these drugs are injectables.

Airlines

The potential impact on airlines has been receiving attention. According to Jeffries, if the average passenger’s weight declines by 10 pounds, a total of 1,790 pounds (812 kgs) per flight will be shed. This results in an annual saving of USD 80 million in fuel costs, per airline.

Apparel

Another industry poised to benefit is apparel. As people lose weight (and potentially become more active), they will need to replace their wardrobes. This has had a particularly positive impact on athleisure.

Addictive Substance Companies

Perhaps one of the less obvious repercussions sits on the receptor side of the equation. If these drugs are so successful at suppressing cravings, Bank of America raises the question of their efficacy in reducing cravings and addictive behaviours in tobacco, alcohol and gaming markets. Users have already reported a reduction in their nicotine intake and suppressed desire to drink alcohol. As research reveals more about these drugs, it is possible that their use is far more widespread than simply helping consumers fit back into their 90s jeans.

As adoption of these GLP-1 drugs increases, we believe industries will adapt to meet new preferences and demands. We also believe that changing consumer habits which stem from taking these weight loss drugs, will create innovative opportunities for existing industries and businesses. Our Best Investment View maintains exposure through its direct Novo Nordisk holding, as well as the Biotech ETF. In addition, we continue to follow trends in this changing landscape in an attempt to identify further opportunity from beneficiary industries and sectors.