2023 in review

During 2023, the US Market Index edged closer to recouping losses from the 2022 bear market. Bonds additionally managed to hold their ground after a tough 2022.

The Federal Reserve played a pivotal role, implementing four interest rate hikes to curb inflation, causing ripples of market fluctuations. As we look ahead, 2024 might witness rate cuts, guided by economic data and inflation trends, ushering in a new phase of uncertainty and opportunity.

In the tech sector, the dominance of the “Magnificent Seven” – Nvidia, Tesla, Meta Platforms, Apple, Amazon.com, Microsoft, and Alphabet – persisted, offering stability amid economic uncertainties. Despite their initial undervaluation, these tech giants are now considered fully valued, yet investors remain eager to pay a premium.

The emergence of Artificial Intelligence (AI) as a significant market trend cannot be ignored. Nvidia’s stellar stock performance and Microsoft’s backing of OpenAI’s ChatGPT propelled the Morningstar Global Next Generation AI Index to a remarkable 75% rise.

Amidst this financial landscape, 2023 witnessed significant events that shaped the business environment:

- TikTok bans go global (February): TikTok faced global bans due to security concerns, escalating actions against the popular social media app, highlighting tensions between the US and China.

- The US had a Banking Crisis (March and May): Silicon Valley Bank, Signature Bank, and First Republic Bank failures triggered the most significant US banking crisis since 2008, prompting government intervention.

- US Summer of Strikes (May): Labour strikes surged globally, resulting in unprecedented gains for workers in various industries.

- Nvidia Hits $1 Trillion Market Cap (May): Chipmaker Nvidia achieved a $1 trillion market value, highlighting the growing importance of AI in the tech landscape.

- Cryptocurrency exchange FTX’s Sam Bankman-Fried Trial (October): FTX’s founder faced trial and was found guilty on all charges, impacting the cryptocurrency industry and investor confidence.

- Microsoft acquires Activision Blizzard (October): Microsoft completed the $68.7 billion acquisition of video-game developer Activision Blizzard, reinforcing its dominance in the gaming industry.

- WeWork filed for Bankruptcy (November): WeWork, once valued at $47 billion, filed for bankruptcy protection, raising questions about the future of ventures whose business plans rely on low interest rates.

- Purdue Pharma Settlement (December): Purdue Pharma’s OxyContin lawsuits reached the US Supreme Court, potentially setting a precedent for corporate use of bankruptcy law.

- The ongoing Russia Ukraine war and Israel Hammas conflict.

- BRICS set to welcome several new countries into its fold widely seen as an opposition movement against the G7.

- Property crises in China that sparked a myriad of interventions by the Chinese government.

- The most anticipated recession that never was – entering 2023 most of the investment community was of the view that a US recession was imminent. The classic “Inverted yield curve” recession indicator was used to support this view. It remains to be seen if the US Fed managed to navigate the economy to a “soft landing” or not.

Lessons from the financial sector underscore the importance of diversification. With the new year comes geopolitical uncertainties, positive economic indicators, and the ever-present challenge of interpreting market signals.

As we navigate 2024, investors are reminded to stay informed and agile, ready to adapt to the evolving financial terrain.

2024 – National elections in focus

2024 is not just an election year, it’s perhaps THE election year. From Russia to South Africa, India to the US, the coming year’s contests could embolden dictators or revitalise democracies.

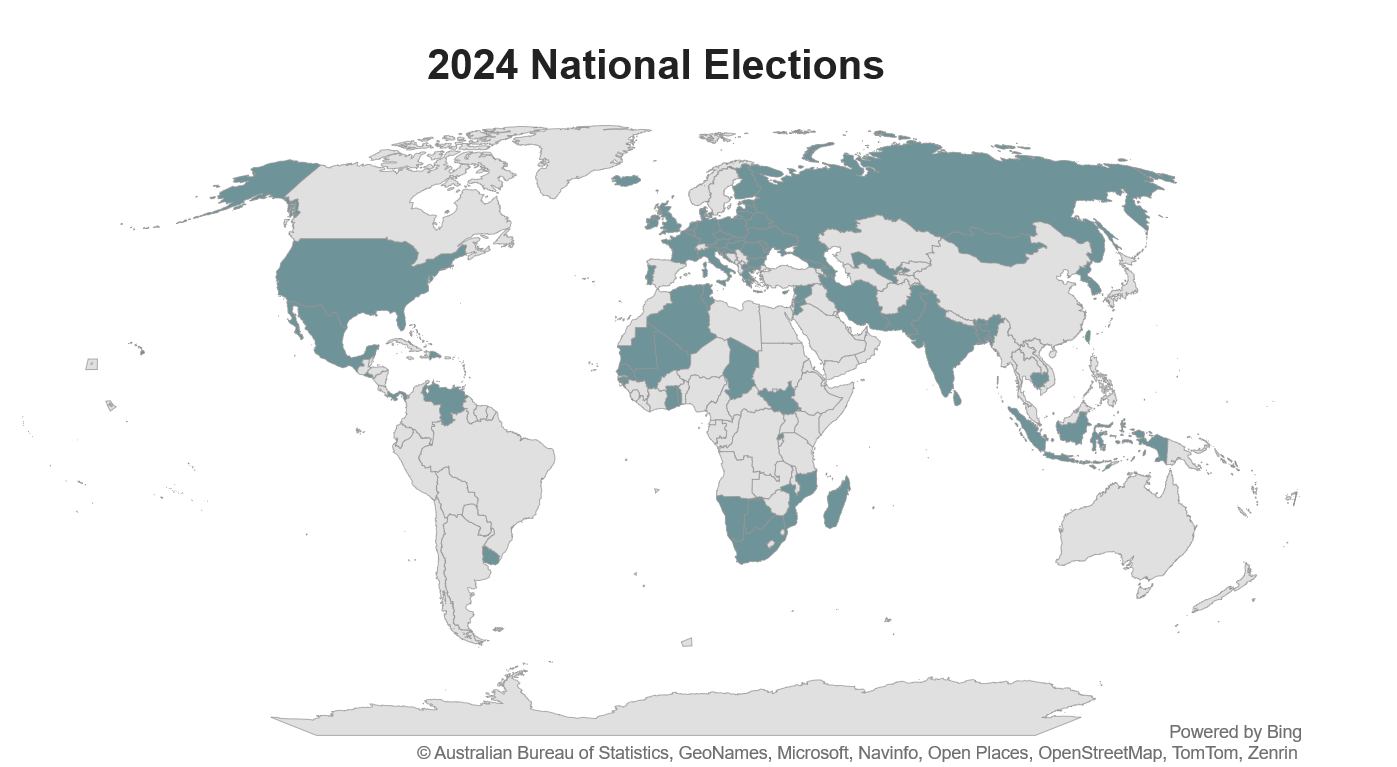

Globally, more voters than ever will head to the polls as at least 64 countries (plus the European Union) – representing a combined 49% of the global population (and an outsized chunk of global GDP) – are scheduled to hold national elections; the results of which, for many, will prove consequential for years to come.

Figure 1

India

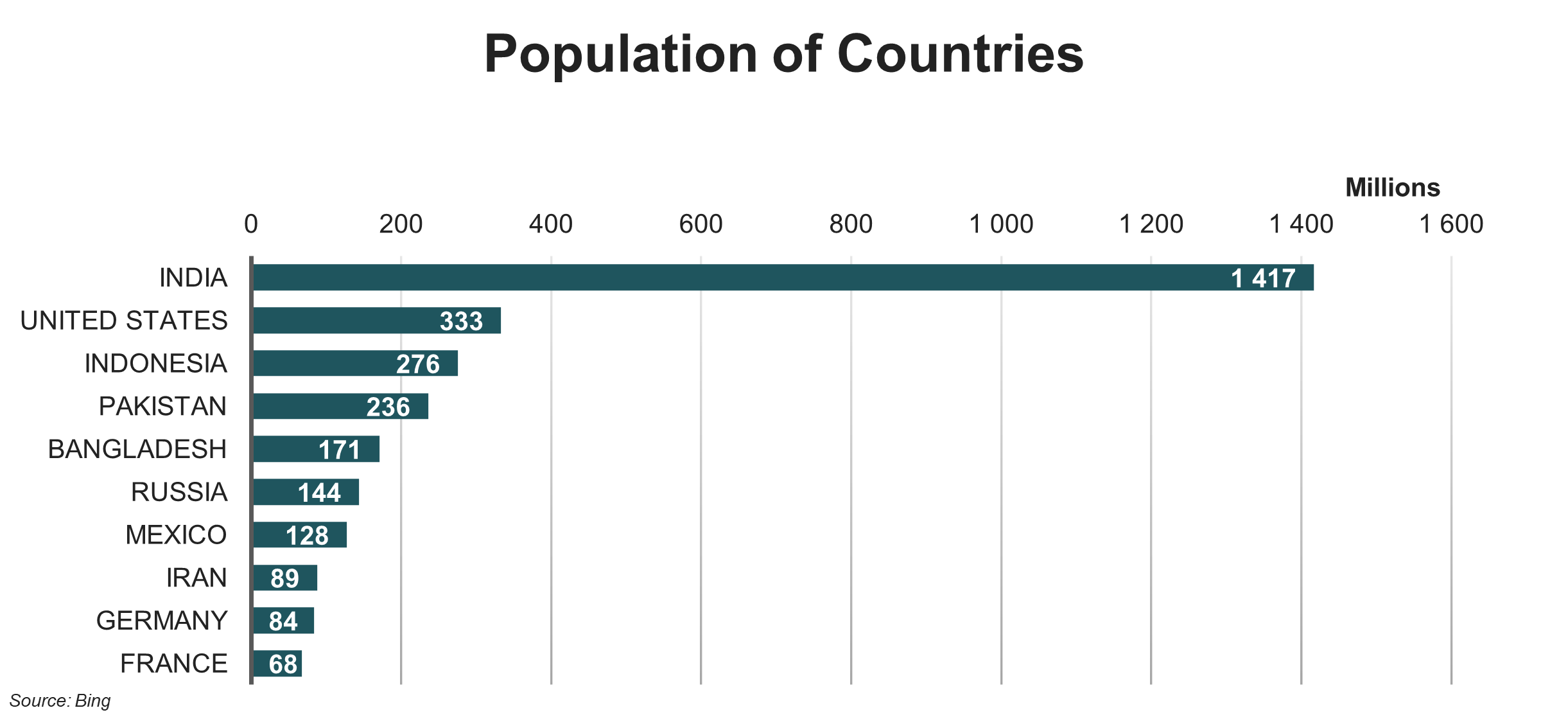

India’s election, between April and May 2024, will be the world’s largest, according to Chatham House, a UK policy institute. Out of a population of 1.4 billion, more than 900 million people are registered to vote. Current Prime Minister, Narendra Modi, hopes to be re-elected for a third five-year term. India is the world’s largest democracy and also an increasingly important geopolitical player.

Figure 2

Mexico

On 2 June 2024, almost 100 million Mexican voters will head to the polls to elect a new president to serve a six-year term. For the first time in Mexico’s history, the two leading presidential candidates are women. The candidates are Claudia Sheinbaum Pardo, former mayor of Mexico City, and former senator Xóchitl Gálvez. Ballot papers across Mexico will also include votes to fill more than 20,000 public positions – a record for the country.

European Union

In the EU, 2024 elections for the European Parliament will take place between 6 and 9 June 2024. More than 400 million voters will elect 720 members of the European Parliament across 27 member countries. As the EU election crosses so many borders, it will be the world’s biggest transnational election.

South Africa

South Africa’s election in August 2024 is expected to be the country’s most important in 30 years. The African National Congress (ANC) party has governed the country since 1994, when apartheid ended, and Nelson Mandela became South Africa’s first Black president. Now there’s uncertainty about whether the ANC can keep its majority, reports Bloomberg. A coalition government in South Africa looks possible, believes polling organization Ipsos – but “not guaranteed”. More than 26 million South Africans are registered to vote, according to the Electoral Commission of South Africa.

United States

The US will head to the polls on 5 November 2024. More than 160 million Americans are registered to vote. They’ll be choosing the 60th US president. Incumbent President Joe Biden hopes to secure a second term in office, while former President Donald Trump is hoping to take back the reigns for a second, non-consecutive term.

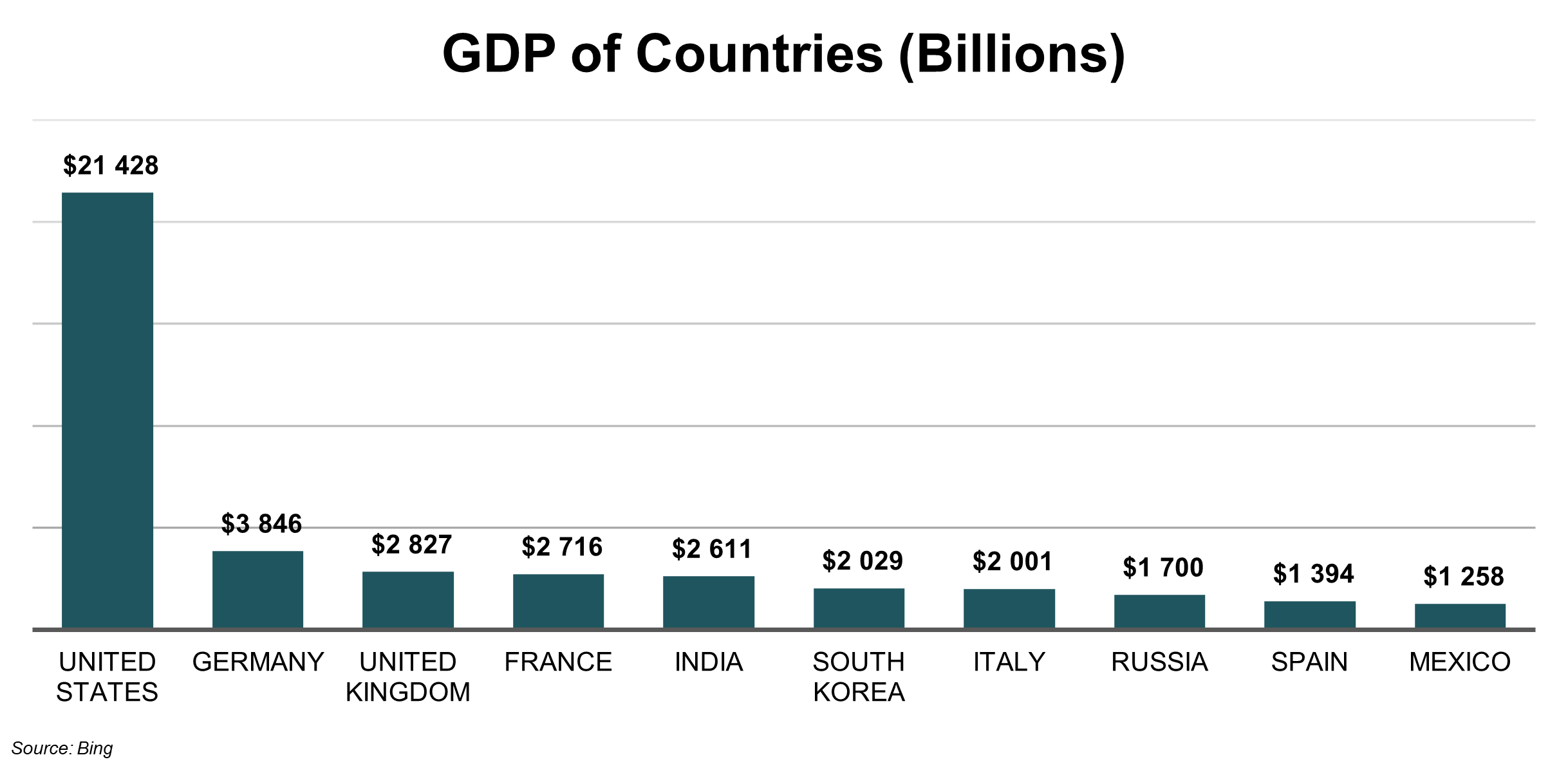

Figure 3

Other 2024 elections

Amongst others, elections in 2024 will also take place in Taiwan, Indonesia, Russia, Iran and Pakistan.

While Vladimir Putin may be embarking on a sure-win re-election campaign, the March presidential election results, if the true vote breakdown is disclosed, may be viewed as a potential indicator of the strongman’s support – and whether the Russian public continues to back his seemingly endless war.

Meanwhile, in Ukraine, it’s unclear if a planned 2024 presidential vote will take place while the besieged nation is currently under martial law, though incumbent leader Volodomyr Zelensky has said he intends to seek another term and his ratings remain high.

Changes in policy, government regulation, interest rates and other areas could make 2024 a “tumultuous year,” Bloomberg suggests. The backdrop of war and economic shocks heightens potential geopolitical risks.

Geopolitical risk

In its Chief Risk Officers Outlook 2023, the World Economic Forum finds that continuing volatility in geopolitical and geoeconomic relations between major economies is the biggest concern for chief risk officers in both the public and private sectors.

Most survey respondents for the report are expecting “upheavals at a global scale”.

This is “unsurprising given the ongoing war in Europe and continuing US-China economic tensions”, the Forum says.

The survey also indicates a growing “adversarial” trend in international economic relations. Higher business costs, trade restrictions, market instability and “sharp swings in policies” are some of the factors underpinning this, the Forum finds.

In Taiwan, for example, who becomes the next president will fundamentally shape Beijing’s approach to the self-governed island it has repeatedly threatened with invasion.

In conclusion

The Pyxis investment philosophy is based on the concept that the investment cycle should be informed by the business cycle. The business cycle is influenced by, amongst others, the political landscape within which businesses have to operate.

Most of the investment destinations that Pyxis focuses on (the US, Europe, Mexico and South Africa) will be impacted this year through national elections. Rest assured that we will keep a close eye on the outcomes, anticipating the knock-on effect for the business cycle and in turn the investment cycle.

View the December 2023 Market Summary

ViewABOUT THE AUTHOR:

Henk Myburgh, CFA®- Head of Research

After completing a BCom Econometrics and MSc in Quantitative Risk Management at the North-West University, Henk Myburgh (CFA), started his career in financial risk management at HSBC. He also worked at Sanlam Capital Markets, where his focus was on consolidation of financial risk across the firm and management of risk on a holistic basis. In 2018 he founded AlQuaTra, a quantitative private hedge fund.