During the course of 2023, China lagged expectations when it came to economic growth and their post-Covid recovery. As we head into the latter half of Q1 2024, the question of whether China will be the market darling of 2024 is being posed. Many are asking whether China has been oversold and wondering whether the year of the dragon will see China rising from the ashes.

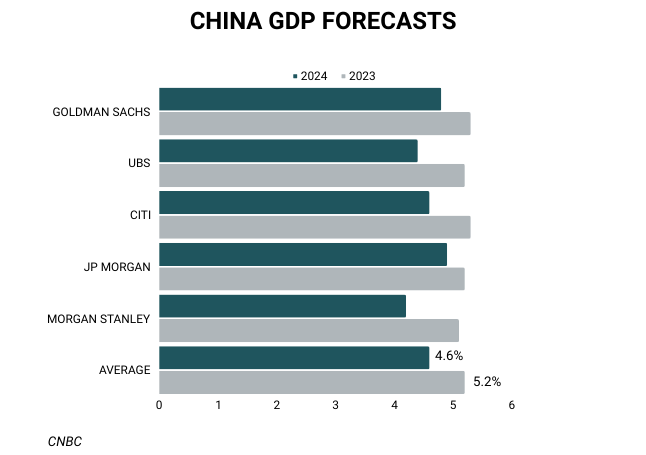

Although firms such as Goldman Sachs, UBS and Morgan Stanley expect China’s economic growth for 2024 to lag that of 2023, the stock market has arguably already re-rated to factor in that slowdown. The slowdown in economic growth expectations is attributed to post-pandemic restrictions’ ongoing impact, as well as the recent real estate slump. According to a CNBC analysis, economic growth expectations ranged from 4.2% to 4.9%. The International Monetary Fund (IMF) has their expectations at 4.6%, while China’s Economic Policy Commission’s release on 20 February 2024 stated that the target for 2024 is around 5%, with 4.8% expected.

“[4.6% expected]…amid continuing weakness in the property market and subdued external demand.” – IMF

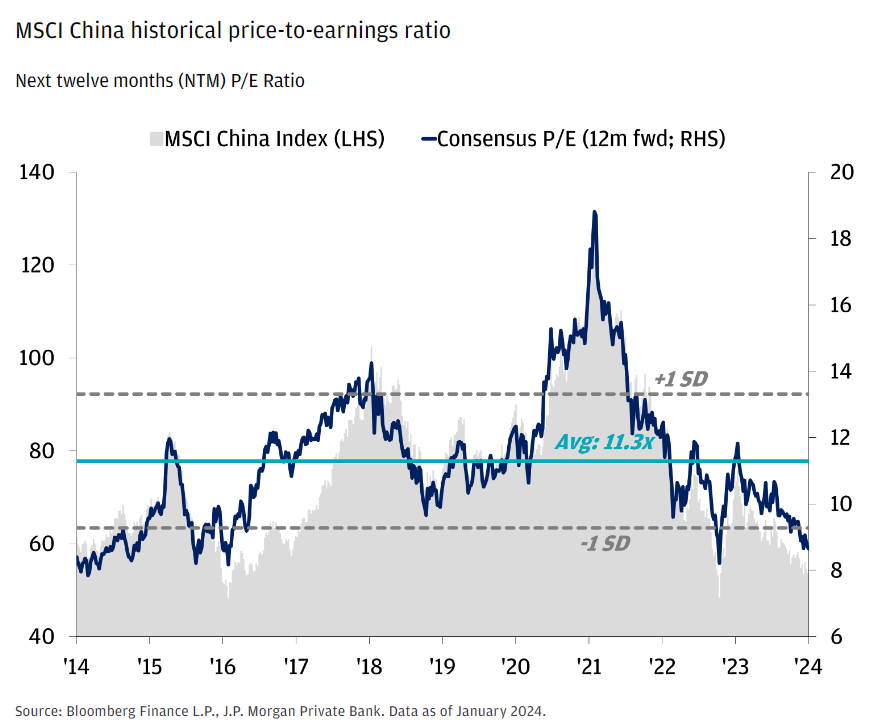

Although China’s economy is expected to “only” grow in the mid-single digits going forward, its growth continues to outpace that of Western developed peers whose growth expectations sit closer to the lower end of the single digit scale. With the stock market declining double digits for 2023 (MSCI China was down 11.2% over 2023) and trades at a 12 month PE ratio low of around 1 standard deviation below the 10 year average (10.2x in January 2024 vs the 10 year average of 11.3x), many analysts are proposing that the economic slowdown is priced in and that 2024 could be the turning point for stock markets.

The Financial Times notes three areas they foresee as being supportive of this narrative.

- Inflation and Monetary Policy

- With China being one of the first countries to start cutting interest rates, capital flows into the region were negatively impacted as investors opted for more lucrative interest rates elsewhere. As rates globally start to decline, Chinese compensation for capital investment will normalise on a relative basis and attract international investment.

- Delay of Post-Covid Economic Recovery

- Although growth upon reopening was subdued, China has been focusing on growth and various measures to stimulate it. From mid-2023, the government has been pro-active in providing stimulus to the economy and there is no indication they will cease these actions in 2024. Consumer sentiment has also been supportive of this with retail sales improving on the back of higher disposable income per capita.

- Geopolitical Risks already Priced In

- Although this risk persists, equity markets appear to have already priced in the potential impact of continued geopolitical instability. Harmonious discussions between President Xi Jinping and President Biden in 2023 bode well for stability. With tariffs negatively impacting US inflation and it being an election year, many expect things to remain amicable between the two nations. The MSCI World China Index 2024 consensus EPS growth is projected to be 14.2%.

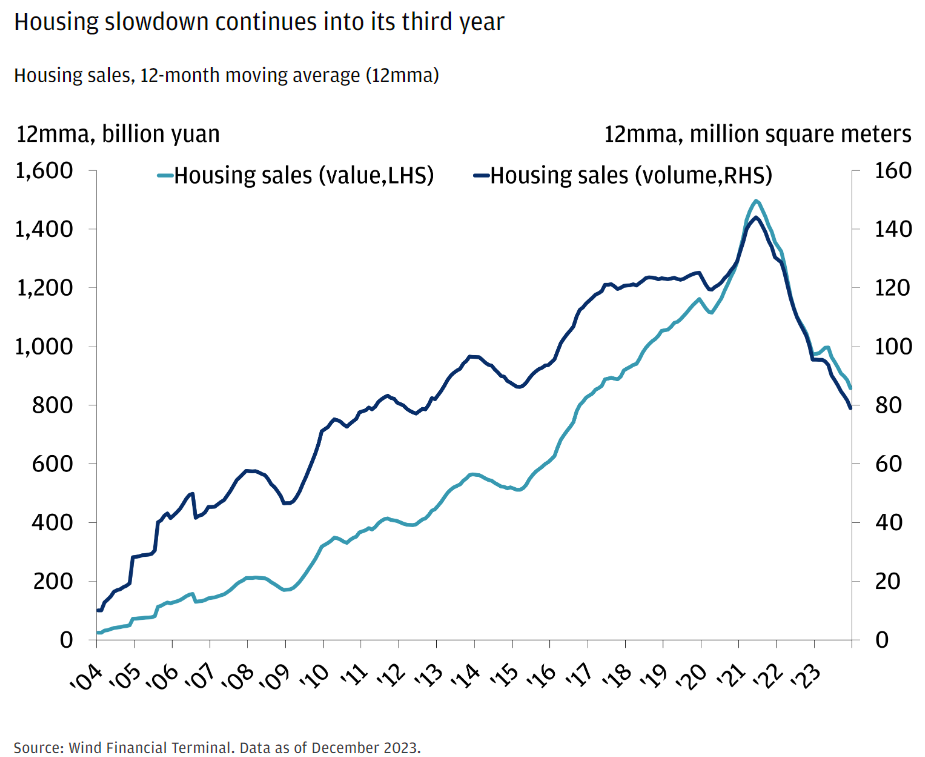

The most notable headwind for 2024 is the property market. In 2017, President Xi first announced the intent of prioritising housing for living. Since then, household saving has favoured capital markets (stock and bond markets) over real estate. Investment into the property sector has dwindled since the onset of Covid. In 2023, investment in real estate development fell by 9.6% year-on-year, the area of houses under construction declined 7.2%, the area of new housing projects declined 20.4%, and housing sales declined 6.5%. The area of houses for sale at the end of the year was 673 million square meters, up 19%. Historically, the real estate sector has accounted for approximately 25% of China’s GDP. As it contracts, the question of whether there will be sufficient growth from other sectors to fill the void remains.

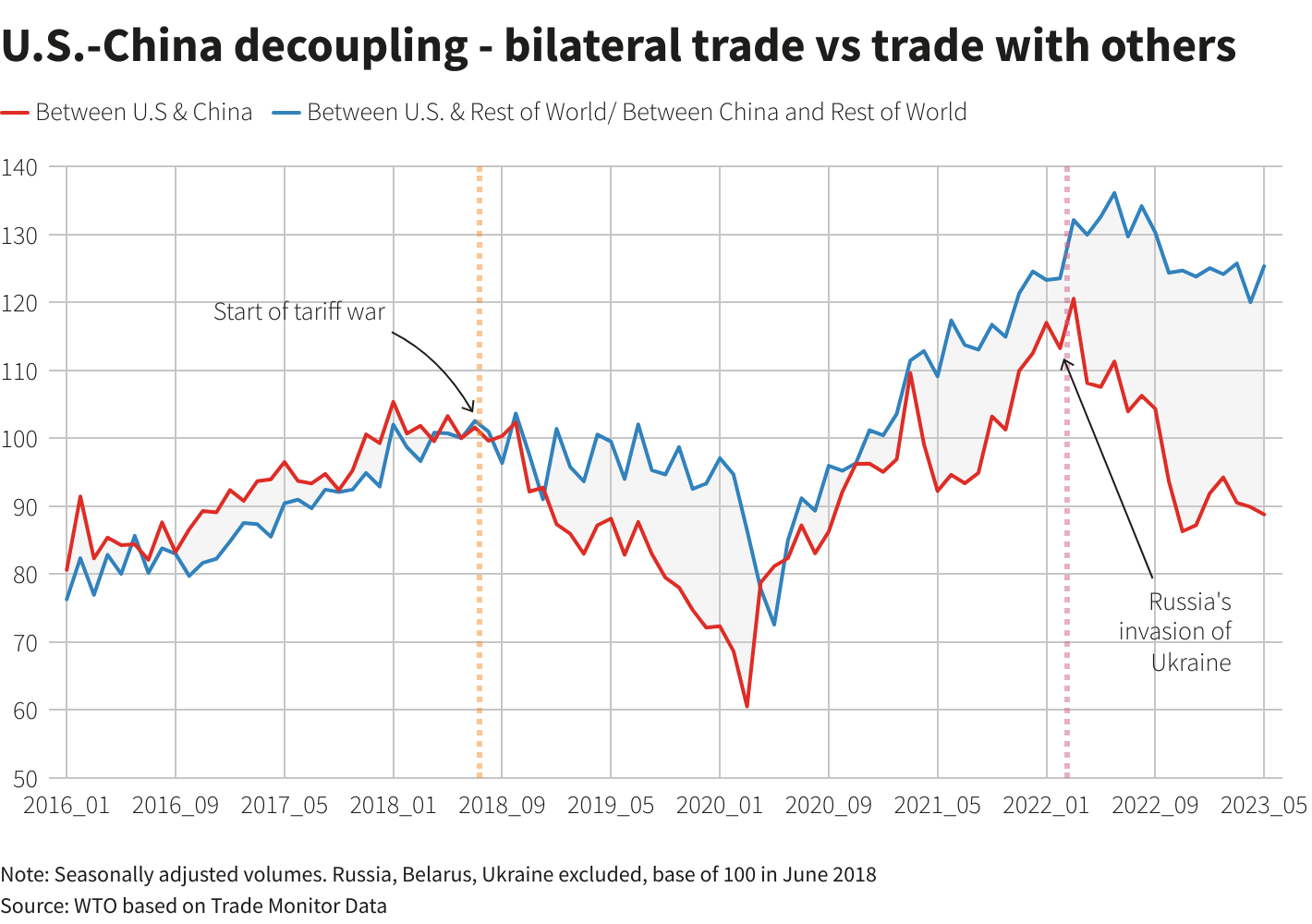

Another area of concern is the stimulus received from exports coming under pressure. As the developed world starts to source goods from closer locations and de-globalise, will there be sufficient demand for Chinese exports? Will further restrictions on Chinese manufactured goods be introduced and negatively impact exports? For example, since 2018, China has ramped up production and exports of vehicles. Their growth from 2021 to 2023 saw them overtake the likes of the US, South Korea and Germany in terms of the number of units sold. As Chinese companies take market share away from the developed world, these countries are incentivised to impose tariffs to protect their own industries.

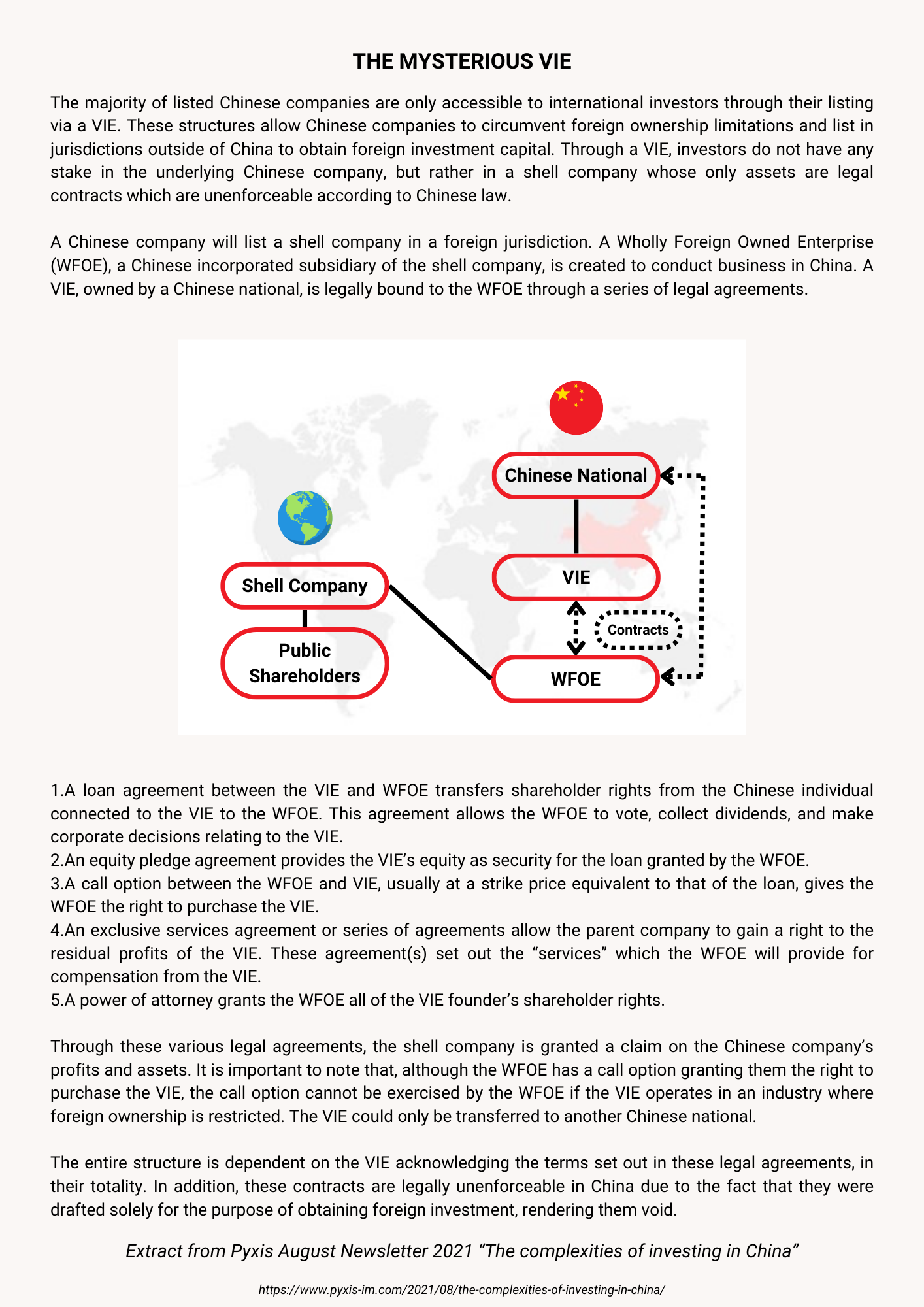

Back in August 2021 we wrote about the complexities of investing in Chinese companies, focusing on the Variable Interest Entity (VIE) structure. Although this piece focused on the impact on South African investors through their indirect ownership in Tencent via Naspers and Prosus, the message is reiterated for all Chinese companies listed offshore through the principle of a Wholly Foreign Owned Enterprise (WFOE)/VIE structure.

In 2023, China announced various amendments to Company Law, coming into effect on 1 July 2024.

“The new Company Law comprises 266 articles, with more than 70 articles being added to or substantially rewritten of the current 218 articles.” – Freshfields Bruckhaus Deringer

The impact on existing companies will be determined by their ability to comply by the 31 December 2024 deadline (as the amendments will be retrospective). All companies will be required to update their articles of association and relevant policies to adhere to the amendments. The implications of not doing so before the deadline are not yet confirmed. Any new companies who register from January 2024 onwards will have to ensure they comply with these updated requirements from the onset.

The complexities continue. Economic recovery could take longer than anticipated; the property market continues to grapple with its own complexities; the Western World is focused on deglobalisation; and the impact of the intricacies of China’s legal framework are difficult to quantify. Although the Chinese stock market appears to be cheap relative to historical norms, we would prefer not to expose portfolios to the risk associated with the various uncertainties which hound the region.