News headlines over the past month have been focused on China’s clampdown on big tech firms and the larger implications for international investors. With Naspers and Prosus being such a large part of our local exchange, and the majority of their value being derived from Chinese tech company Tencent, it is important to understand how this could potentially impact South African investors.

Chinese regulators require entities to obtain State Council approval prior to listing on any exchange in a foreign jurisdiction. Privately owned companies (as opposed to state owned enterprises) are unlikely to obtain the required approval.

Chinese law limits, and in many cases prohibits, foreign ownership in Chinese companies. The scarcity of local capital for privately owned Chinese firms, coupled with the Western world’s desire to gain access to the growing economy of China incentivised businesses and investors to find a way around the strict legislation. Chinese firms sought out a way to gain access to foreign capital and foreign investors were eager to participate in the growth rates being achieved in China. The Variable Interest Entity (VIE) structure allowed for both parties to achieve their respective goals.

“Companies that use the VIE structure tell two inconsistent stories. To Chinese regulators they say that the business is owned by Chinese and not by foreigners. Yet, to foreign investors they claim that foreigners own the business.”

–PL Gillis and F Oqvist; GMT Research

THE MYSTERIOUS VIE

The majority of listed Chinese companies are only accessible to international investors through their listing via a VIE. These structures allow Chinese companies to circumvent foreign ownership limitations and list in jurisdictions outside of China to obtain foreign investment capital. Through a VIE, investors do not have any stake in the underlying Chinese company, but rather in a shell company whose only assets are legal contracts which are unenforceable according to Chinese law.

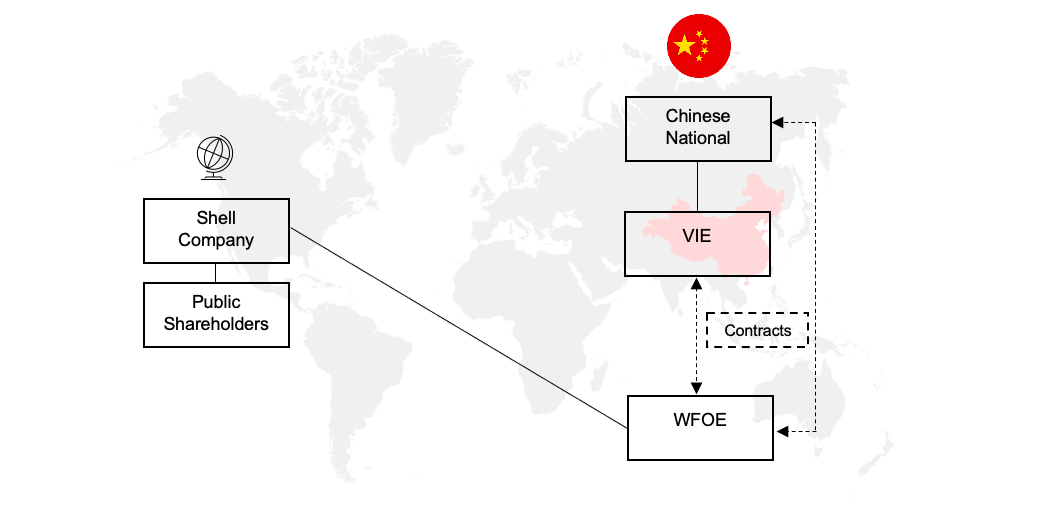

A Chinese company will list a shell company in a foreign jurisdiction. A Wholly Foreign Owned Enterprise (WFOE), a Chinese incorporated subsidiary of the shell company, is created to conduct business in China. A VIE, owned by a Chinese national, is legally bound to the WFOE through a series of legal agreements.

- A loan agreement between the VIE and WFOE transfers shareholder rights from the Chinese individual connected to the VIE to the WFOE. This agreement allows the WFOE to vote, collect dividends, and make corporate decisions relating to the VIE.

- An equity pledge agreement provides the VIE’s equity as security for the loan granted by the WFOE.

- A call option between the WFOE and VIE, usually at a strike price equivalent to that of the loan, gives the WFOE the right to purchase the VIE.

- An exclusive services agreement or series of agreements allow the parent company to gain a right to the residual profits of the VIE. These agreement(s) set out the “services” which the WFOE will provide for compensation from the VIE.

- A power of attorney grants the WFOE all of the VIE founder’s shareholder rights.

Through these various legal agreements, the shell company is granted a claim on the Chinese company’s profits and assets. It is important to note that, although the WFOE has a call option granting them the right to purchase the VIE, the call option cannot be exercised by the WFOE if the VIE operates in an industry where foreign ownership is restricted. The VIE could only be transferred to another Chinese national.

The entire structure is dependent on the VIE acknowledging the terms set out in these legal agreements, in their totality. In addition, these contracts are legally unenforceable in China due to the fact that they were drafted solely for the purpose of obtaining foreign investment, rendering them void.

THE CLAMPDOWN ON TECH

Chinese technology companies are considered value-added telecommunications businesses resulting in a limit of 50% on foreign ownership. Many Chinese tech companies are listed using a VIE, thus bypassing regulatory restrictions imposed on them.

The risk lies in Chinese regulation eliminating the loophole that the VIE structure exploits, and foreign owners suffering losses in the process.

In 2009, regulators published Xin Chu Lian’s Notice 13, prohibiting the use of contractual agreements to control internet gaming operators. In 2011, regulation required foreign acquisitions of domestic companies undergo national security review, even if done through a VIE. Later the same year the China Securities Regulatory Commission promoted more restrictive legislation for VIEs. In 2015, the Ministry of Commerce drafted legislation to outlaw VIE’s.

Minasheng Bank and Gigamedia are two examples of VIE shareholders attempting to enforce contents of their VIE legal agreements and failing against Chinese regulation. More recently we have seen regulators preventing IPOs, such as the suspension of the USD 34 billion IPO of Chinese online payments platform Ant Group (previously known as Alipay).

Due to the fundamentals of the VIE structure under which these Chinese companies are listed, the risk of regulators leaving foreign investors with cents on the dollar, or worse, is high. Much legal uncertainty remains. The US-China Economic and Security Review Commission has recently recommended that legislation be put in place to prohibit Chinese companies from issuing shares through VIEs in America

“Even when you think China risk is priced, it can get worse”

-Goldman Sachs

This legal uncertainty has been seen across global markets as investors opt out of holding Chinese shares, evident in the USD 769 billion decline in value of these US listed Chinese companies over the past 5 months (Bloomberg) and companies such as Ant Group and Didi making headlines. Friday, 23 July 2021, saw an 8.5% fall for the Nasdaq Golden Dragon China Index, with a further 7% drop on Monday, 26 July 2021. This, the largest decline since 2008, was in response to Chinese regulators announcing increased scrutiny of private education companies (education being another government restricted sector), with proposed restrictions on company profits, capital raises and going public. Having peaked in mid-February, the Nasdaq Golden Dragon China Index is down 43.25% from that point to the end of July 2021.

TENCENT

Tencent is one of the many companies operating in a government restricted sector, prohibited from having foreign ownership. Tencent set up a shell company in the Cayman Islands. Through a multitude of legal agreements, the shell company is granted a claim on the profits of Tencent’s assets (but no ownership). The shell company was then listed, under the Tencent name, in America. When we invest in Naspers or Prosus we are not actually gaining ownership of Tencent or its assets, rather a claim on profits and assets via a VIE structure which is based on unenforceable contracts.

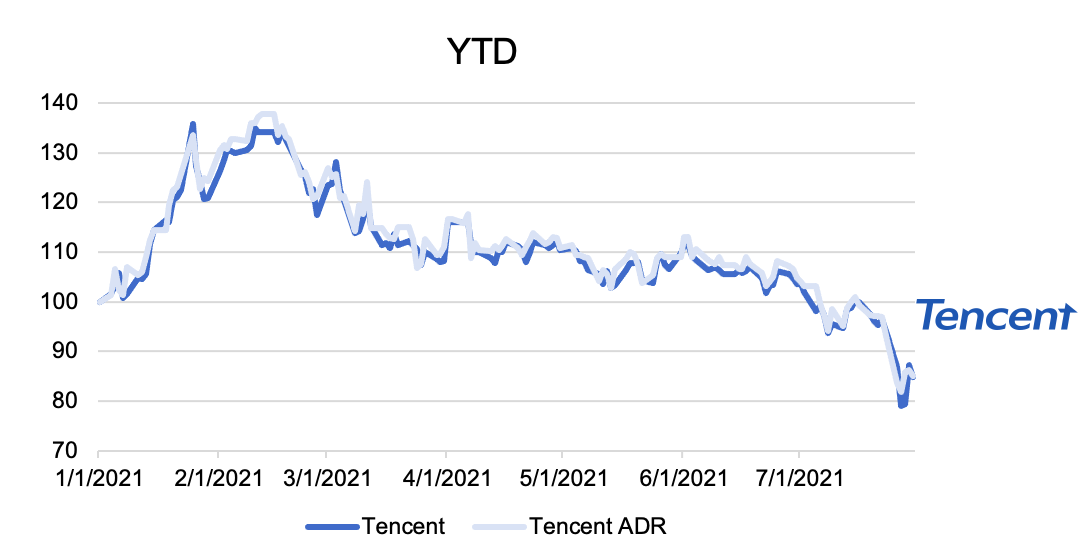

Tencent was not immune to the happenings in the latter part of July. The share fell 10% on Monday 26 July as a result of being required to give up music licensing rights. The government could impose further penalties on the tech company or enforce legal restrictions to the detriment of foreign investors.

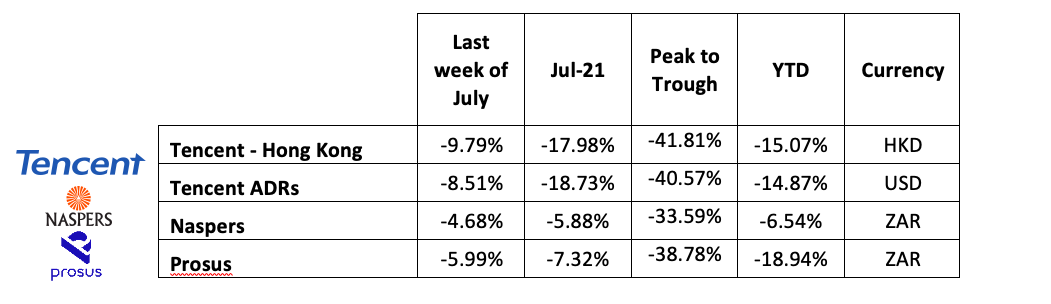

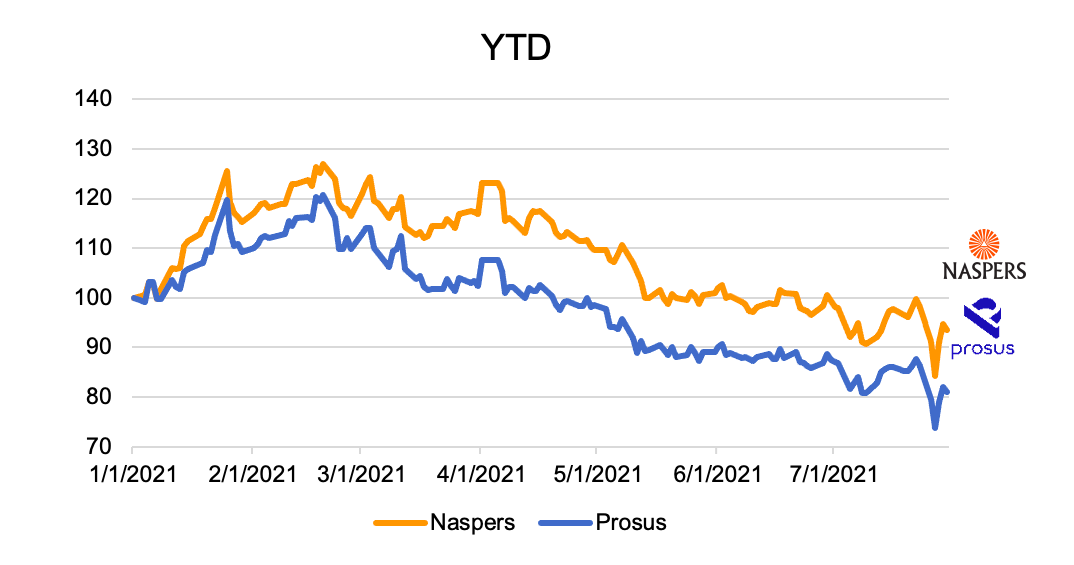

For the month of July, Tencent is down 17.98%. Naspers and Prosus have fared similarly. Peak to trough, these shares are all down more than 30%.

Although the risks associated with the VIE structure are not new, with heightened geopolitical factors between China and the Western world, coupled with Chinese regulators employing new data security monitoring methods specifically focused on securities fraud, the likelihood of these risks causing permanent capital loss is highlighted. Being underweight Naspers, Prosus and/or Tencent is prudent and a view we have held for some time. China may have turned a blind eye historically, but a change in stance and their recent crackdown could mean their leniency is over.

ABOUT THE AUTHOR:

Ashley Pedlar, CFA® – COO

Ashley obtained her MCom in Investment Management at the University of Johannesburg and is also a CFA charterholder. She was selected to participate in the CFA Equity Research project in 2015/16. Her team’s success in the local leg took them to Chicago in 2016, where they placed in the top 6 of the EMEA region. During her time at Sasfin Wealth she was a regular feature on the ‘Biweekly Friday midday market crossing’ on SAFM.