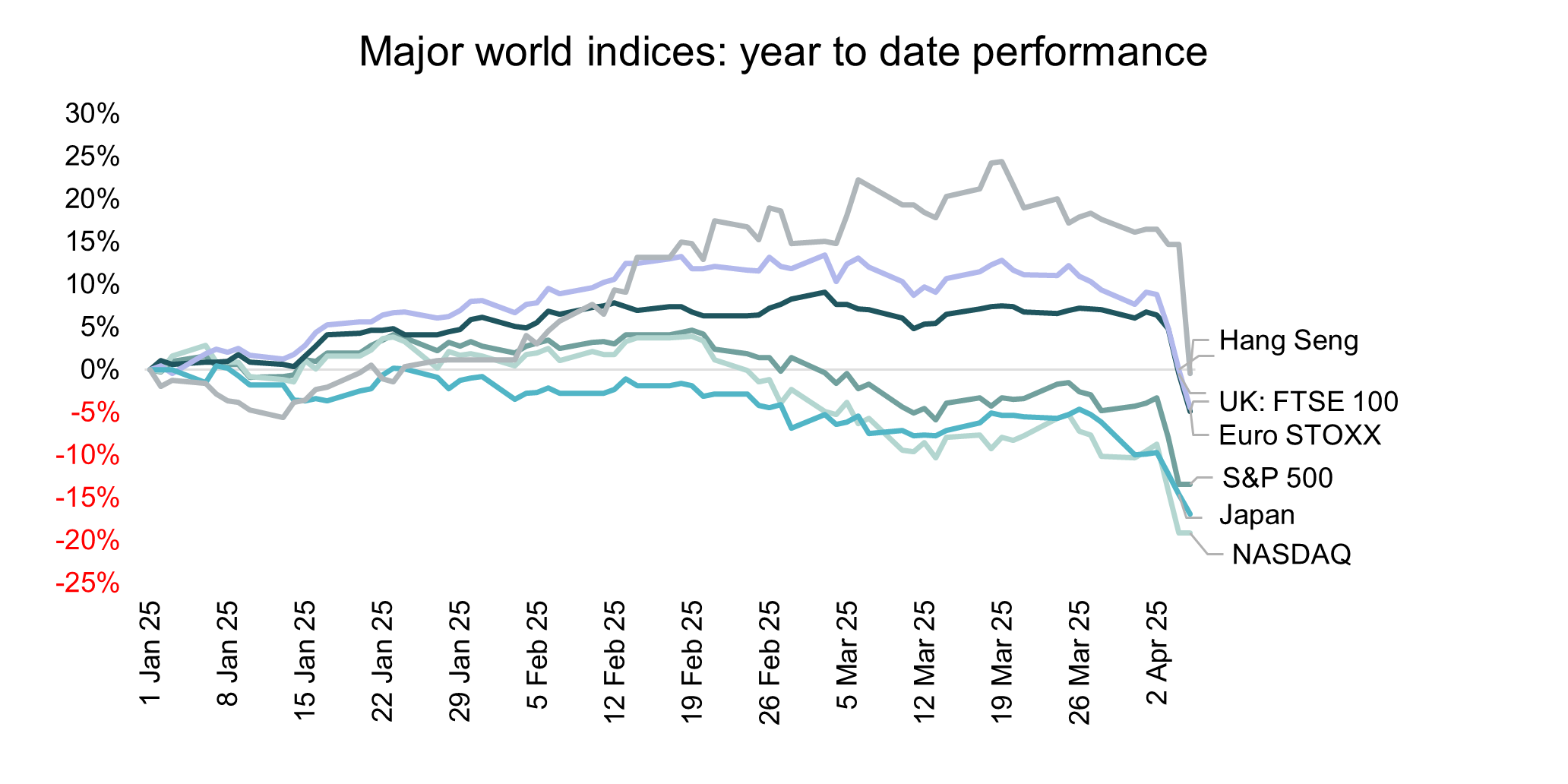

US and global stock markets have been thrown into disarray by US President Donald Trump’s April 2 “Liberation Day” trade tariff policy announcement. This is not the first time President Trump has sparked a global trade war. He initially utilised trade tariffs during his first term as president to support his Make America Great Again (“MAGA”) campaign. Trump’s economic strategy of “putting America first” is based on his belief that the US is being “ripped off” and “cheated” by its trading partners, who he believes manipulate their currencies. The difference, this time around, lies in the extent of the trade tariffs (or so called “reciprocal” tariffs), both in terms of size and broad geographic reach.

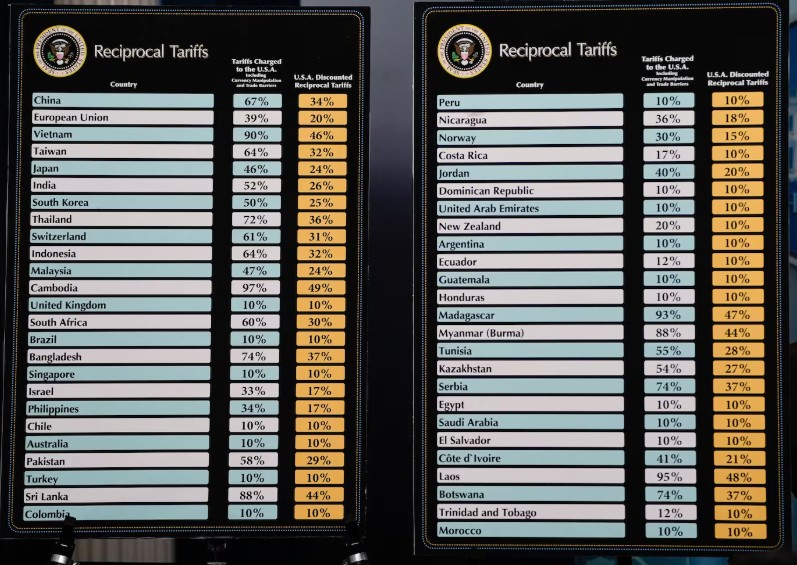

The trade tariffs announced by Trump entail a 10% baseline rate on all goods imported into the United States, as well as additional reciprocal tariffs on goods imported from a list of countries Trump calls the “worst offenders”. For instance, a 34% reciprocal tariff will be charged on Chinese imports, in addition to the 20% announced earlier this year, bringing the total to 54%. Interestingly, Canada and Mexico won’t be subject to the baseline rate as a 25% tariff has already been imposed earlier this year (there have been some exemptions and delays announced since).

Furthermore, the president confirmed the implementation of a 25% tariff on all foreign made automobiles.

What are tariffs?

Tariffs are taxes imposed by a government, on goods and services imported from other countries. Think of a tariff like an extra cost added to foreign products when they enter the country. They’re usually a percentage of the price of the goods. The level of the tariff will affect the significance of its impact.

Why do governments impose tariffs?

- Raise government revenue – tariffs serve as a source of income for governments.

- Protect domestic industries and correct trade imbalances – tariffs shelter domestic industries from foreign competition and discourage consumption of imported goods.

- Political tool for negotiations – tariffs can be used to apply pressure on the foreign government they are imposed on, as part of a trade negotiation or a political tool.

For example, the Trump administration has justified imposing tariffs on Canada, Mexico and China, to pressure foreign governments into addressing illegal immigration and drug trafficking, while also addressing the size of the country’s trade deficit.

What impact do tariffs have on the economy imposing them?

Domestic industries may benefit from reduced foreign competition. If foreign goods are now relatively more expensive, this would drive up demand for domestic products, allowing domestic industries to expand and increase production.

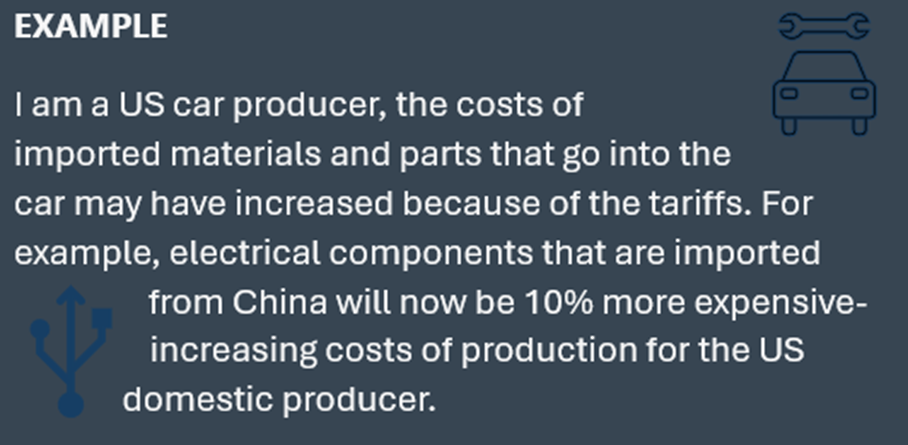

However, some domestic industries have global supply chains that rely on imported materials and parts. As prices of imported materials and parts increase, domestic producers may face higher costs of production. If the domestic producers pass higher costs of production onto consumers, it will also push up prices of domestically produced goods.

Notably, the economies that are initially ‘tariff imposers’ may end up facing retaliatory tariffs, which has been the case in the current climate. Below we highlight some potential tariff impacts on the economies tariffs are imposed on.

What impact do tariffs have on the economies they are imposed on?

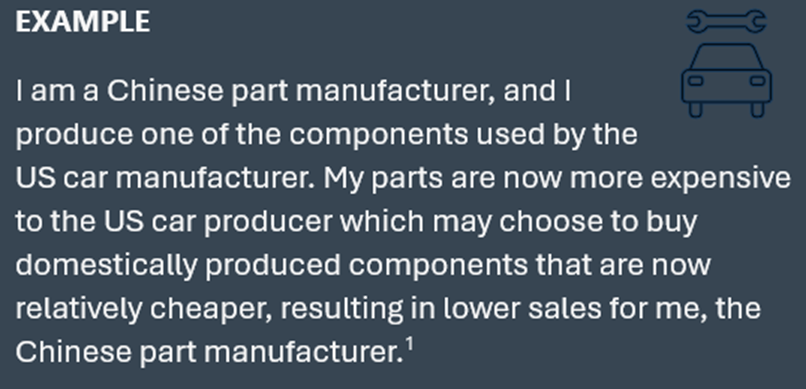

In the country that tariffs are imposed on, targeted industries will face lower export demand. As their goods have become relatively more expensive in the importing country, it will lead to lower sales and lost market share, as consumers switch to relatively cheaper domestic goods. The degree of this decline depends on the price elasticity of demand, how much consumers adjust their purchases of imports in response to the higher prices caused by the tariffs. This may be the case if there are few alternatives in the domestic market, or consumers have a strong brand preference, for example.

The extent of the impact will depend on how much of the country’s production is exported, and particularly, how much is exported to the country imposing the tariff. In Canada, for example, exports make up 33% of Gross Domestic Product and exports to the US specifically account for 20% of Gross Domestic Product.

Industries in countries that tariffs are imposed on may adjust their export strategies to minimise losses, by seeking other markets with more favourable tariff regimes to sell to. Redirecting trade to alternative markets however comes with its challenges, including: regulatory barriers, logistics and distribution costs – establishing new supply chains takes time and investment, and existing competition may be well established in alternative markets.

Source: Oxford Economics

While Trump is of the opinion that imposing trade tariffs on imported goods may reduce America’s trade deficit with its trading partners, create investment in the manufacturing industry and create jobs, there are many criticisms of trade policies like tariffs and barriers to entry. Firstly, most economists argue that trade tariffs lead to increased inflation as costs are driven higher. The higher costs of imported goods will either be passed on to consumers (should they continue to consume the now more expensive imported product, leading to inflation) or be absorbed in the profit margins of importing companies should alternative, cheaper domestically manufactured goods exist (leading to lower company profits). Imposing trade tariffs may also lead to less innovation and productivity over time, as domestic industries are now “protected” and face less competition. As per the Oxford Economics summary above, companies may also have to invest significantly, finding new markets and redesigning logistics infrastructure – adding costs that must be absorbed by increasing prices (or cutting profit margins). Trade tariffs may additionally spark a trade war and retaliatory tariffs that further exacerbate the negative impact on economies and markets. China has already, on Friday 4 April, announced countermeasures against the US tariffs, by adding 34% tariffs to US imported goods and limiting export of some rare earth metals to the US.

On balance, the trade tariffs create much uncertainty and risk to the global economy. Tariffs and a trade war may well negatively impact economic activity, cause higher inflation and interest rates and may actually lead to lower productivity levels and job losses. Needless to say, as we enter what seems to be a new era of global trade dynamics, uncertainty as to the global economy and capital markets, will cause increased volatility.

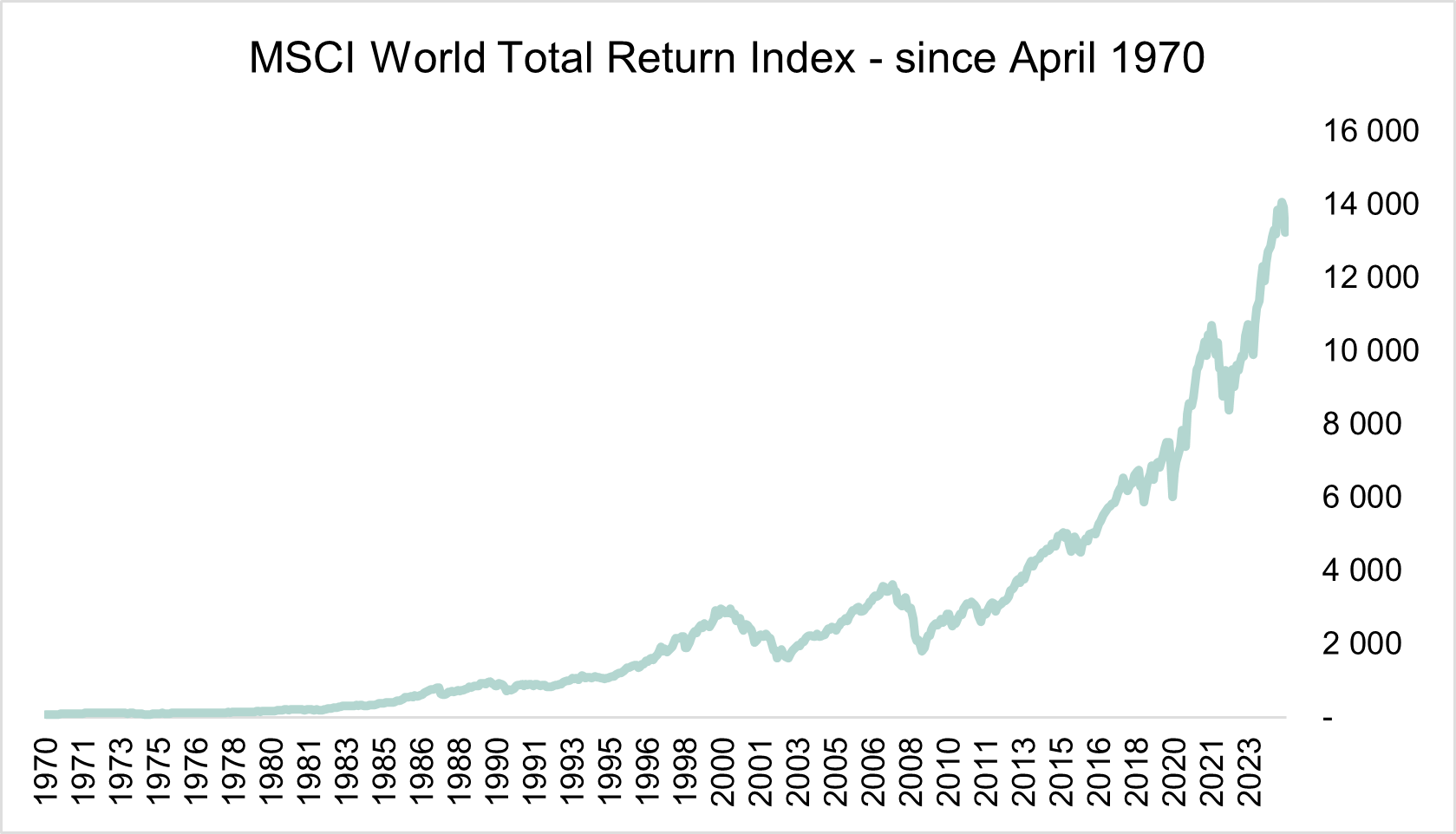

Financial crises rear its head every now and again and financial markets exhibit increased volatility as new paradigms are evaluated and assessed. One thing we know for sure however, is that people are resilient, innovative and quickly adjust to new environments. Acquainting oneself again with a long-term chart of the MSCI World Index (a basket of all the global stock markets), proves this point. There have been many crises over the last 100 years, but once the dust settles and necessary steps are done, things return to “normality”.

Rest assured, well diversified investment portfolios and investments into high quality companies have stood the test of time.