The Healthcare Sector at a Glance

The Deloitte US Center for Health Solutions conducted research across developed markets and highlighted various trends for 2025 and going forward. The key factor identified to influence the sector over the short- and medium-term was digital transformation. Substantial investment into technological advancements is expected from healthcare organisations, with 60% of respondents highlighting the need to invest in core technologies (electronic medical records and enterprise resource planning software). This adoption and implementation should lead to operational efficiency gains for the industry in the long-term. Deloitte points out that the global shortage of healthcare workers is expected to continue into 2025, particularly in lower income countries. The World Health Organisation (WHO) has estimated a shortfall of 10 million healthcare workers by 2030. This will most likely lead to higher costs for those operating in the space, either as they are required to increase wages to incentivise workers (impact over the short-; medium- and long-term) or as they invest in technologies to perform roles previously performed by individuals (short- to medium-term cost impact, but anticipated reduction thereafter).

Global healthcare spending is expected to outpace inflation by 1.9% (according to the EIU). Human health is expected to be impacted by lower public spending in the short-term, climate change and war – all resulting in increased long-term demand.

Anti-obesity medications are expected to continue to drive pharmaceutical sales growth in 2025, with existing shortages of GLP-1 agonists additionally expected to continue. Shortages in antibiotics, insulin and painkillers in the EU are also expected to continue. While regulations in the EU and US are expected to remain a contested topic, with both regions aiming to contain process and improve competition in the sector (Inflation Reduction Act (IRA) in the US, and the EU’s proposed and amended “pharmaceutical package” of regulations). Finally, firms are expected to continue investing in supply chain diversification and increased manufacturing capacity to counter drug shortages and reliance on Chinese imports.

“Global healthcare spending will grow by about 6% in US-dollar terms in 2025, comfortably outpacing slowing inflation. This real-terms increase will be driven primarily by public spending in low- and middle-income countries, but growth will also be rapid in wealthier countries with ageing populations. About 12% of the world will be aged 65 or older in 2025, pushing up demand for healthcare services. However, governments will find it difficult to fund care as budgets are diverted to defence, green subsidies and infrastructure spending.” – EIU

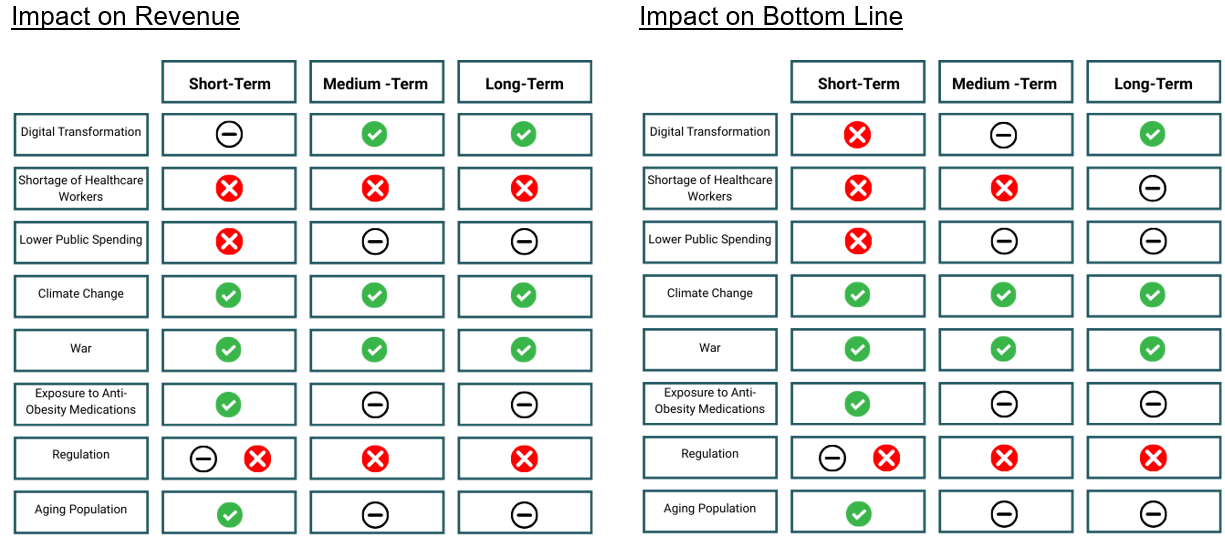

The below tables summarise these factors and their potential impact on revenue and profit for pharmaceutical firms, all else equal, assuming no improvement or change over the term:

Trump Administration

The US healthcare industry has been subject to budget cuts since 2019, as well as constrained reimbursement growth at a time when Medicaid and Medicare enrolment is increasing. This, coupled with inflation and labour shortages has been challenging for those operating within the sector.

McKinsey anticipates moderate growth in EBITDA for the US healthcare sector over the medium-term. This improvement is expected to come from post pandemic margin recovery and inflation pass through. They similarly highlight Healthcare Service Technology as a key growth area, along with Specialty Pharmacy.

The main goal of the Trump administration has been to focus on prevention as opposed to treatment, an enhancement of personalised care and an effort to reduce the cost of drugs for the patient. PWC identifies four areas/means to this end:

- flexibility and choice: shifting decision making from federal level to states and individuals;

- fiscal conservatism: emphasis on policies which reduce government spending and pass tax legislation;

- public health reform: re-evaluate the current health system; and

- deregulation: reduce existing federal regulations.

Overall, the Trump administration may result in supply chain disruptions and budget constraints.

Healthcare expenditure accounts for approximately 25% of the federal budget, a large proportion for a fiscus with budget constraints. Tariffs are anticipated to lead to supply chain issues and cost increases. On the other hand, deregulation around M&A activity should be positive, resulting in more timely deal approvals and fewer restrictions.

The Inflation Reduction Act

Signed into law under President Biden in August 2022, the Inflation Reduction Act of 2022 prioritised three core goals:

- combat inflation;

- invest in domestic energy production and manufacturing; and

- reduce carbon emissions.

In its attempt to reform healthcare, the bill specifically legislated that Medicare would be able to negotiate pricing for prescription drugs and expanded the Affordable Care Act programme into 2025.

On 15 April 2025, President Trump issued an Executive Order which included the “improvement” of the Inflation Reduction Act by addressing the “flaws” of the pill penalty and treatment of small-molecule drugs under the Medicare Prescription Drug Price Negotiation Program. The Act, as it currently stands, stipulates that small-molecule drugs (generally cheaper and used for the treatment of larger patient populations) become candidates for Medicare price-setting 7 years post FDA approval, while negotiation for biologics (usually more expensive and used for the treatment of rare diseases) is only applicable 11 years post FDA approval. This discrepancy in timing and the potential impact on the development and affordability of small-molecule drugs has been referred to as the pill penalty.

Critics have argued that the shorter time frame before small-molecule drugs are subject to government price setting disincentivises research and development of these drugs, in some cases in favour of biologics. The higher adoption and utilisation of small-molecule drugs means that there is a potential that drug availability is negatively impacted over the longer term if fewer developments are made. Should supply dwindle, the cost of these medications could be adversely affected, negating the intent behind the Inflation Reduction Act.

An article published by medRxiv found a 70% reduction in early-stage Research and Development funding for small-molecule drugs since the introduction of the Act, potentially having a detrimental impact on the availability and accessibility of low cost essential treatments going forward (PhRMA).

A new analysis by healthcare consultancy Vital Transformation, published the day before the executive order, found that investment in small-molecule R&D has declined by 68% since the IRA was enacted and by 74% for diseases that primarily affect Medicare patients. Additional evidence from a National Pharmaceutical Council study highlights early signs that the IRA may also be dampening investment in post-approval clinical development. Meanwhile, a policy brief from the University of Chicago estimates that the law could result in 188 fewer small-molecule treatments and indications reaching the market – potentially translating into a loss of 116 million life-years.

Source: https://becarispublishing.com

President Trump’s order aims to align the time frame for eligibility of small-molecule drugs with that of biologics – both of which would then become eligible for negotiation 11 years post FDA approval. The extension of the timeline for small-molecule drugs has received mixed commentary from proponents and opponents alike. Proponents have argued that addressing the pill penalty would incentivise smaller firms to embark on research and development of more affordable small-molecule drugs; opponents have argued that the extension of the timeline only benefits Big Pharma by delaying access to the most used drugs at reasonable prices.

The order stipulated that the Secretary of Health and Human Sciences must liaise with Congress to implement changes to legislation which make President Trump’s reformation of Medicare’s negotiating power possible. The timing of which is uncertain, and the impact thereof speculative at this stage.

Which drugs are impacted by the Act?

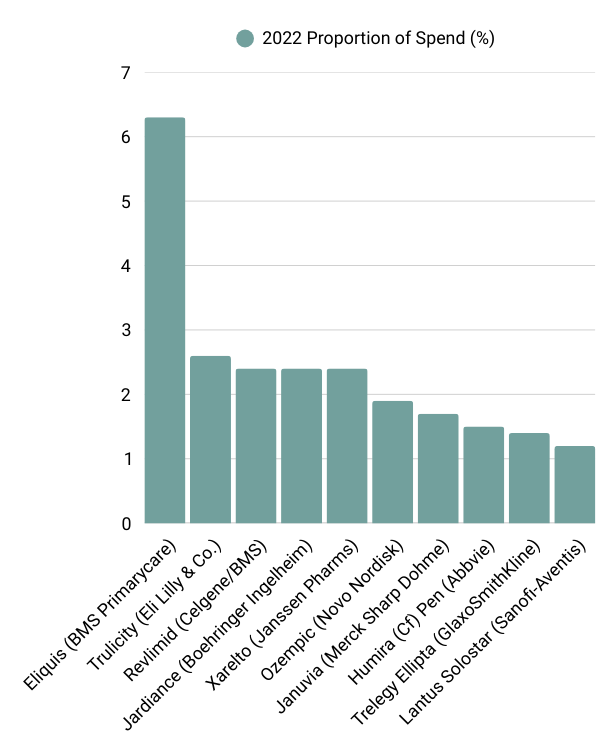

According to the most recently available data from the Centers for Medicare and Medicaid Services (2022), the below table outlines the top 10 drugs, ranked by Medicare spend.

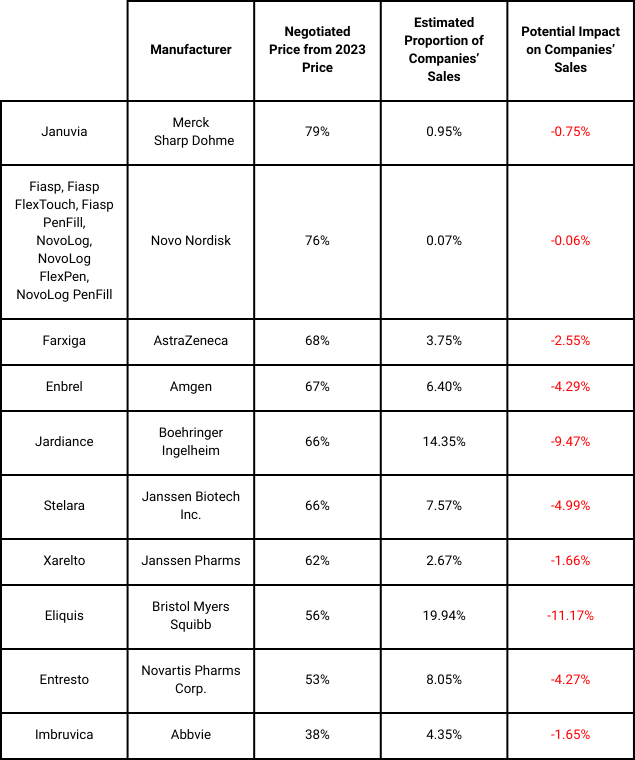

Of these drugs, Eliguis, Jardiance, Xarelto and Januvia fell into Phase 1 of the Medicare drugs selected for price negotiation. These negotiated prices go into effect next year (1 January 2026). These price reductions range from 38% to 79% discounts for the 10 drugs. A quick analysis of the potential impact on sales for each of the companies, based on the latest available segmental company data, is outlined in the below table. It is important to note that these estimates are based on total US sales per drug and not solely on the proportion sold via Medicare, as that data is not readily available.

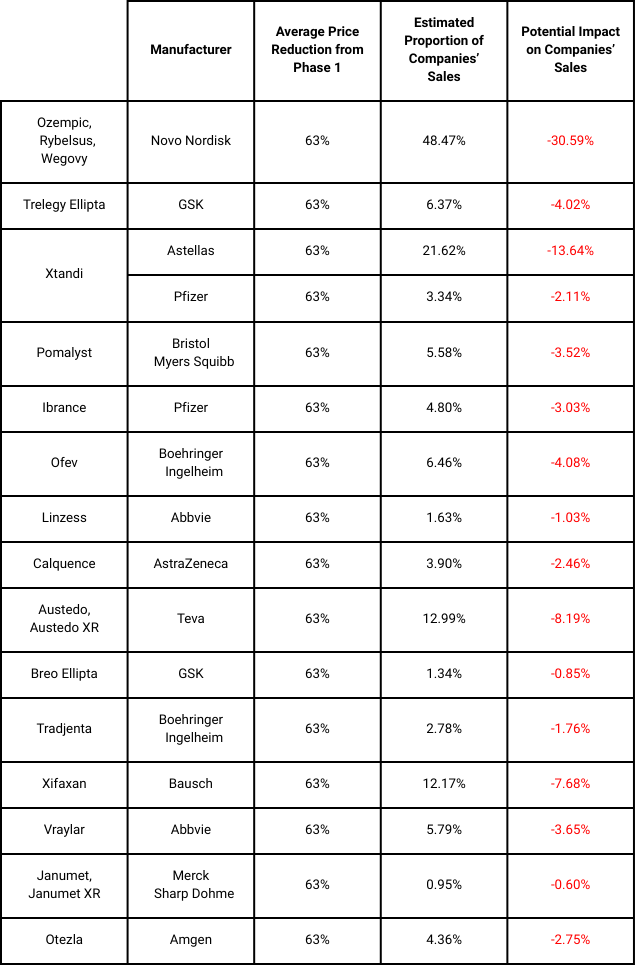

Ozempic and Trelegy have been included in the subsequent list of 15 drugs set for price negotiation and applicability from 2027. The negotiation period ends on 1 November 2025. Based on the average price reduction in Phase 1, an estimate of the potential impact on the various companies highlighted for Phase 2 is summarised below:

Going forward, an additional 15 drugs will be selected for the third cycle of negotiations and up to 20 drugs per annum thereafter.

It is evident that the implementation of price reductions stands to have a material impact on pharmaceutical companies’ sales and bottom line. This, coupled with the various factors highlighted impacting the industry in the short- to medium-term, necessitate investor focus and awareness with regards to funds allocated to the sector. We continue to follow developments as they occur and remain vigilant of the risk associated with uncertainty, ready to act should it be deemed appropriate based on a client’s investment mandate.